Image:

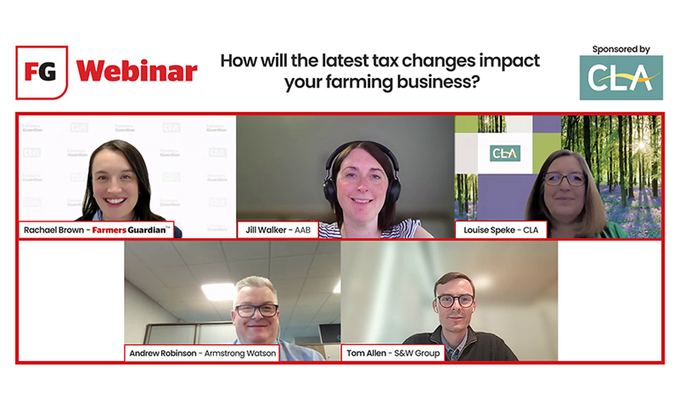

FG Webinar on tax changes from April 2025

Watch the replay of Farmers Guardian's FREE webinar held on April 24 in partnership with the CLA, which discussed the latest tax changes farming businesses need to be aware of. WATCH NOW: The...

.png)