Business Property Relief

Politics

A judicial review challenging the Government’s proposed changes to Agricultural Property Relief (APR) and Business Property Relief (BPR) has been granted an urgent ‘rolled-up’ hearing in the High Court

51AV��ƵLife

Efra chair Alistair Carmichael says while changes to family farm tax are welcome, more needs to be done to protect single farmers

Politics

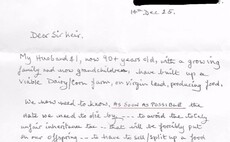

The farmers, both over 90 years-old, said Inheritance Tax changes could lead to their farm business being split up and sold, leaving them trapped in an unfair system. They asked the Prime Minister what date they need to die to avoid tax reforms

Politics

Could Prime Minister Sir Keir Starmer finally be ready to change the Government's policy stance on Inheritance Tax changes?

51AV��ƵLife

FG explains what happens next as proposed Inheritance Tax changes move through Parliament

Politics

The Prime Minister was challenged by Efra Chair Alistair Carmichael at the Liaison Committee last year on the impact of Inheritance Tax changes on farmers' mental health

Politics

South West Norfolk MP Terry Jermy said Labour has an opportunity to reconnect with farmers if it makes changes to APR, adding that the party gained votes from rural communities which revolted against former Prime Minister Liz Truss and previous Tory Governments which 'failed' them in trade deals

Politics

Suffolk Coastal MP Jenny Riddell-Carpenter abstained on a vote to back the Government's changes to Inheritance Tax last week. The Labour MP explains why she could not support the changes at a time when the farming sector is on its knees

Politics

Middlesbrough South and East Cleveland MP Luke Myer joins Labour colleagues including Ben Goldsborough, Steve Witherden, and Samantha Niblett in declaring why he abstained from a vote on Inheritance Tax changes

Politics

TFA chief executive George Dunn writes for Farmers Guardian on the Autumn Budget, Chancellor Rachel Reeves' lack of engagement with farmers, and how she can start to restore confidence in the tenant farming sector

27 January 2026

•

4 min read

27 January 2026

•

4 min read